In this article, we delve into the key findings of the ASH 2025 Report (Action on Smoking and Health), Vaping Behaviour among adults in Great Britain. Drawing from ASH Smokefree GB survey data (n=13,314), we highlight the most important behavioural trends in the report.

Who Vapes in the UK

Overall trend changes in adult e-cigarette user demographics

In 2025, 10.4% of adults (around 5.5 million) use e-cigarettes in the UK. The overall usage rate has declined from 5.6 million (10.7%) in 2024 to 5.5 million (10.4%) in 2025, marking the first decline after continuous growth since 2012. This indicates that overall market growth has stabilized. Disposable devices have substantially exited the market, and subtle shifts in user behaviour are emerging. Affected by the dual influences of policy and market changes, the market has entered a platform period.

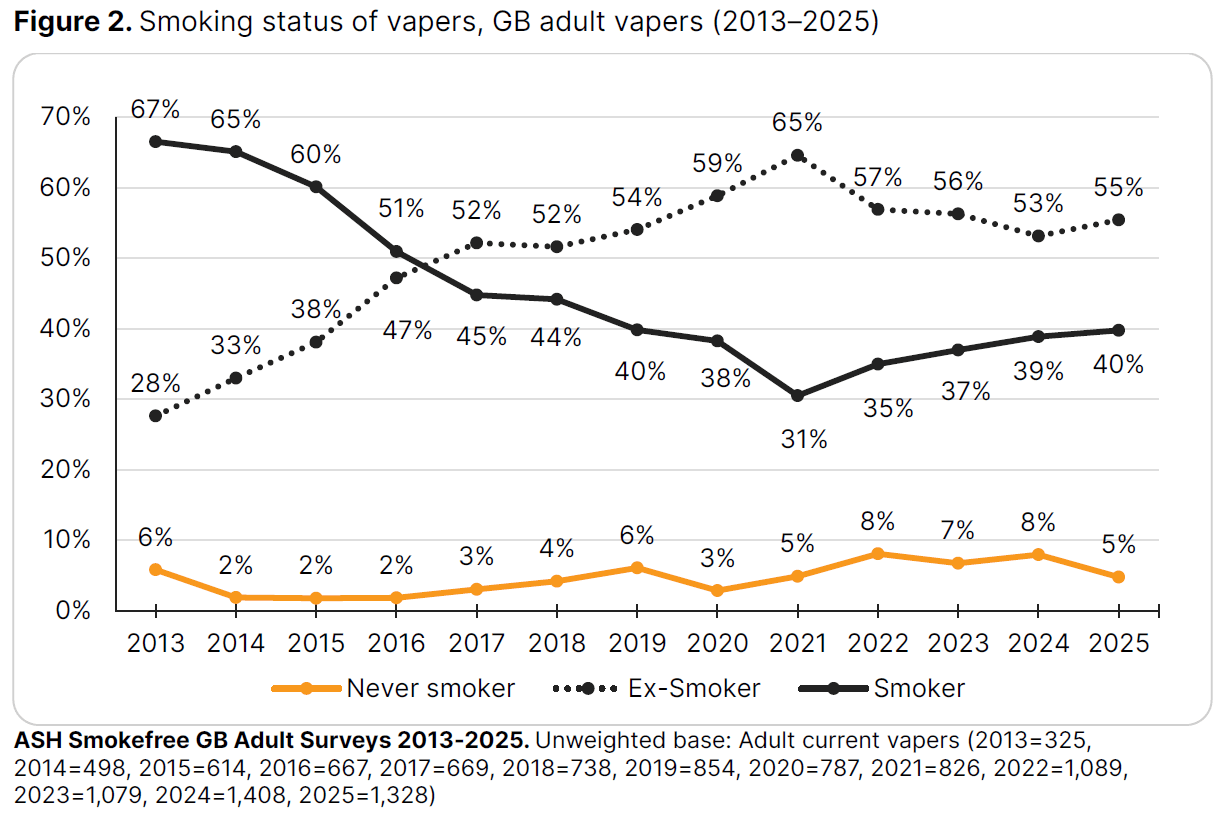

E-cigarette User Composition

• Current smokers: 33% vape (2.2 million).

• Ex-smokers: 18% vape (3.0 million).

• Never-smokers: 0.9% vape (260,000).

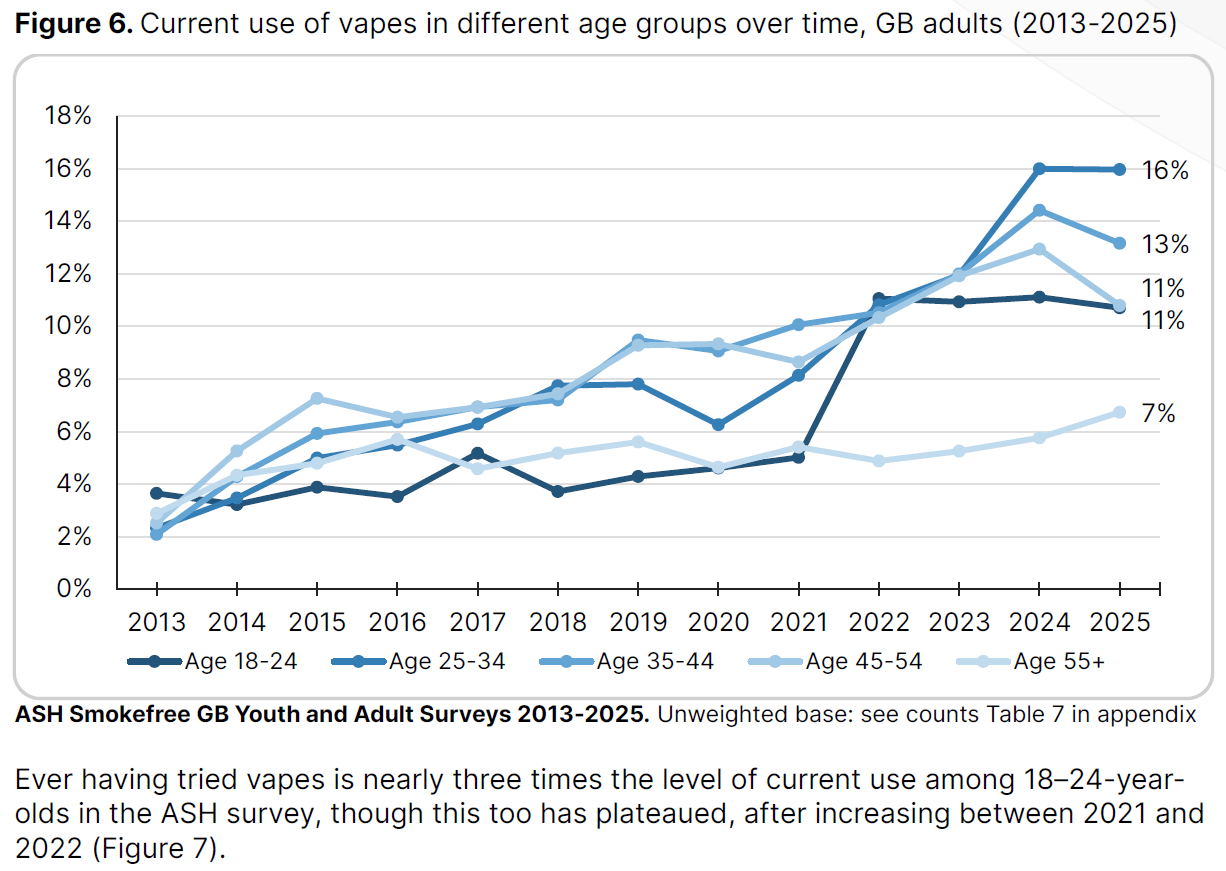

Trends in E-Cigarette Usage Rates Across Age Groups

• Young Demographics Driving Growth: Fastest growth in 18–24 age group (+12%), reached 16% in 2025; 25–34 age group followed (13%), both significantly higher than other age groups.

• Rising Use Across All Ages: Usage rates among ages 35+ increased 8–10 times over the decade. By 2025, usage in the 55+ group (7%) exceeded youth rates in 2013 (4%).

• Indicators of Plateau: 18–24 usage rate modestly declined since the 2022 peak (17%), Growth stagnated in the 25–34 group after 2023.

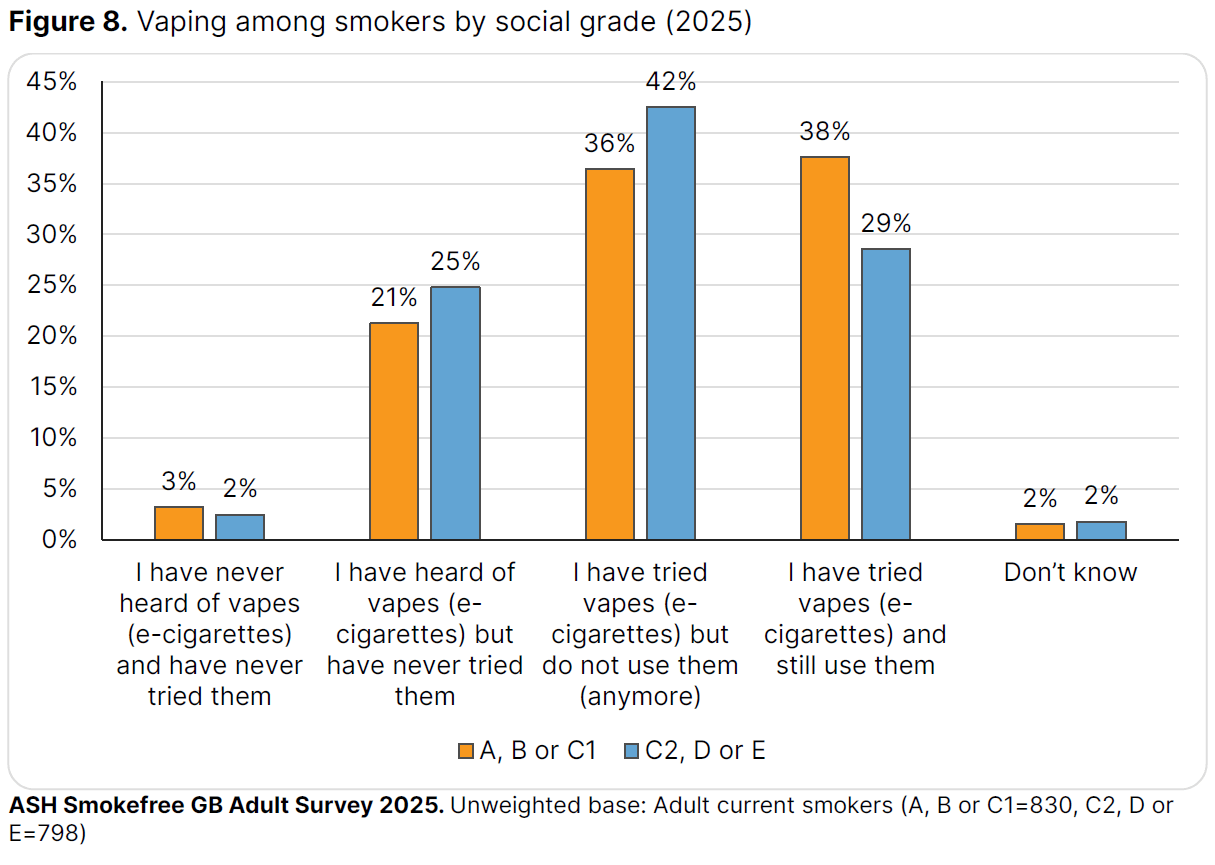

E-cigarette Usage by Age & Social Grade

• Across all age groups under 55, e-cigarette usage rates have stabilized.

• Among smokers of social grade C2DE, e-cigarette usage rates are lower than those of social grade ABC1.

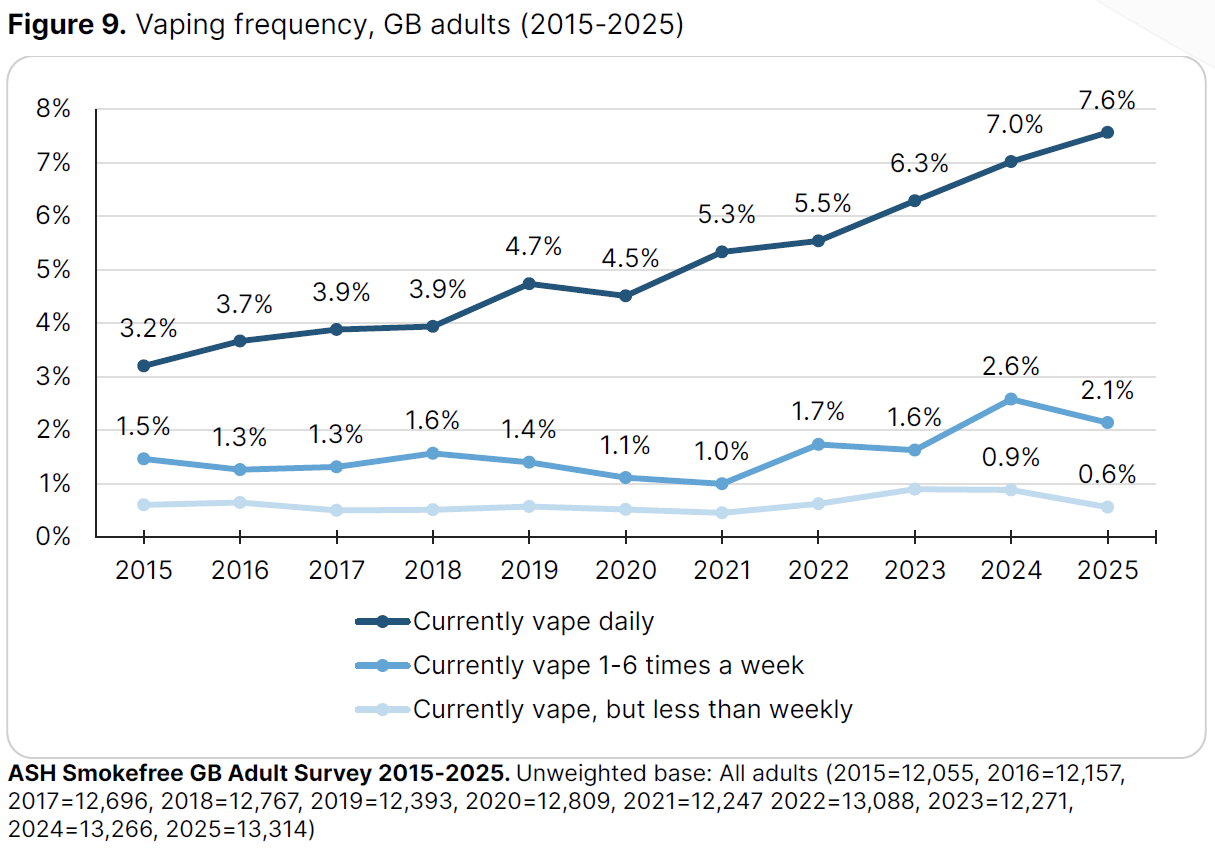

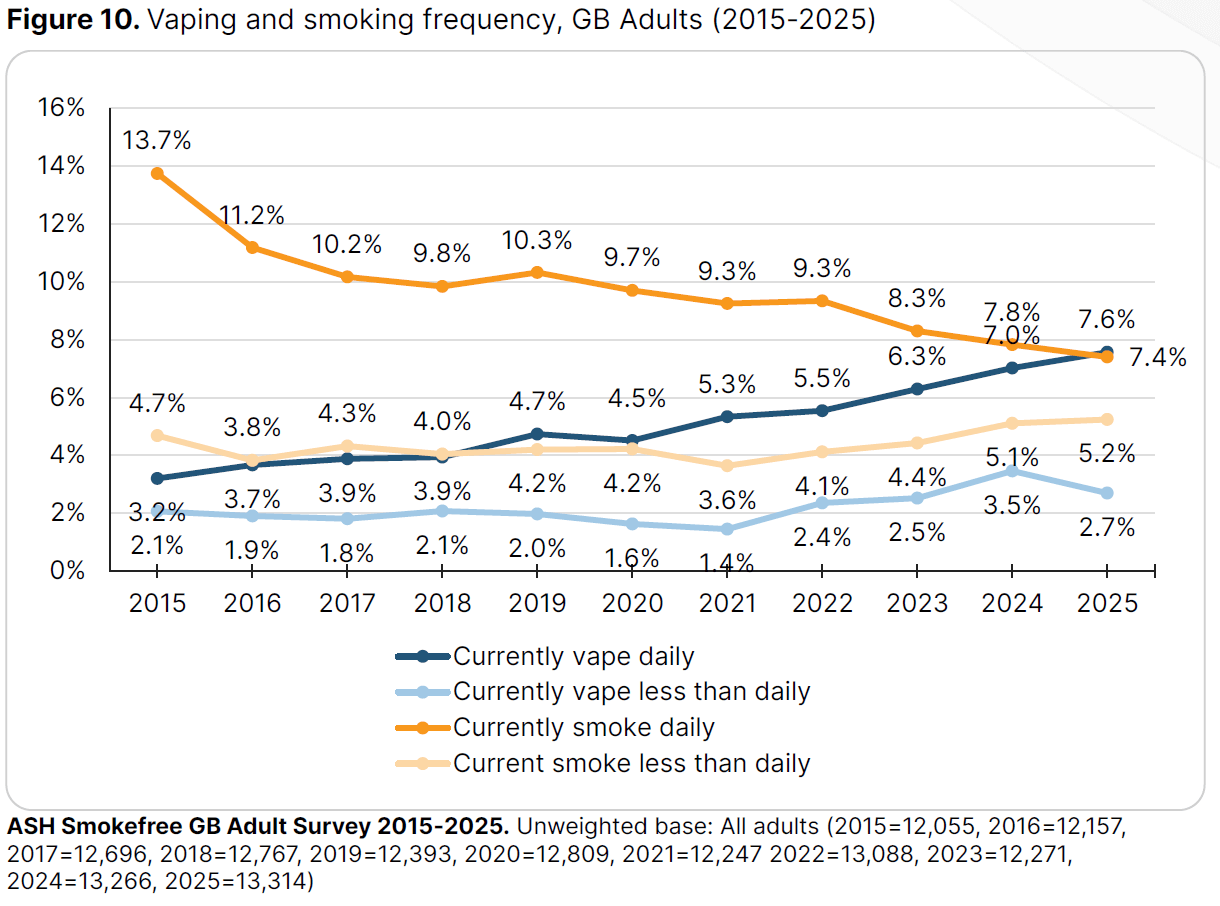

Changes in Duration and Frequency of E-cigarette Use

Among current e-cigarette users, the proportion of daily users has increased yearly, with over half being former smokers who use e-cigarettes.

• Currently, 7.6% of people use e-cigarettes daily, a proportion that has risen annually over the past five years (compared to only 4.5% in 2020).

• Among former smokers using e-cigarettes, 91% use them daily; among dual users (concurrently using cigarettes and e-cigarettes), this figure is 49%.

• 58% of former smokers using e-cigarettes have used them for over three years.

Changes in Smoking Cessation Effectiveness from E-cigarette Use

E-cigarettes in the UK are increasingly evolving along a "harm reduction tool" pathway, transitioning from a "smoking cessation aid" to a "cigarette substitute."

• Dual users (daily smokers + daily e-cigarette users) plummeted from 44% in 2015 to 14% in 2025, indicating a significant weakening of concurrent daily dependence on both products.

• Non-daily smokers + daily e-cigarette users surged from 16% in 2015 to 28% in 2025, demonstrating that more dual users are shifting toward e-cigarettes as their primary daily substitute, reducing cigarette dependence. This marks the transition of e-cigarettes from a "cessation aid" to a "cigarette replacement.

Why Do UK Users Choose E-Cigarettes

Examining User Motivation Stratification and Cognitive-Behavioral Patterns

Respondents report using e-cigarettes for both functional (e.g.quitting or cutting down) and psychological (e.g., stress relief) reasons. Findings highlight the importance of communicating both risks for non-smokers and harm reduction evidence for smokers.

Primary Reasons for E-Cigarette Use

Core motivation of smokers

• Ex-smokers: quitting (26%), relapse prevention (20%).

• Smokers: reduce smoking (16%), enjoyment (13%).

• Never-smokers: stress (35%), enjoyment (31%).

User satisfaction with e-cigarette use and public perception of harm

More than half of users believe that the satisfaction of e-cigarettes is comparable to or greater than traditional cigarettes, and there is a misconception that it is harmful to the public.

E-cigarette satisfaction survey

• 65% of ex-smokers find vaping as or more satisfying than smoking.

• Barriers faced by smokers to vaping: fear of substituting one addiction for another (25%), safety concerns (15%).

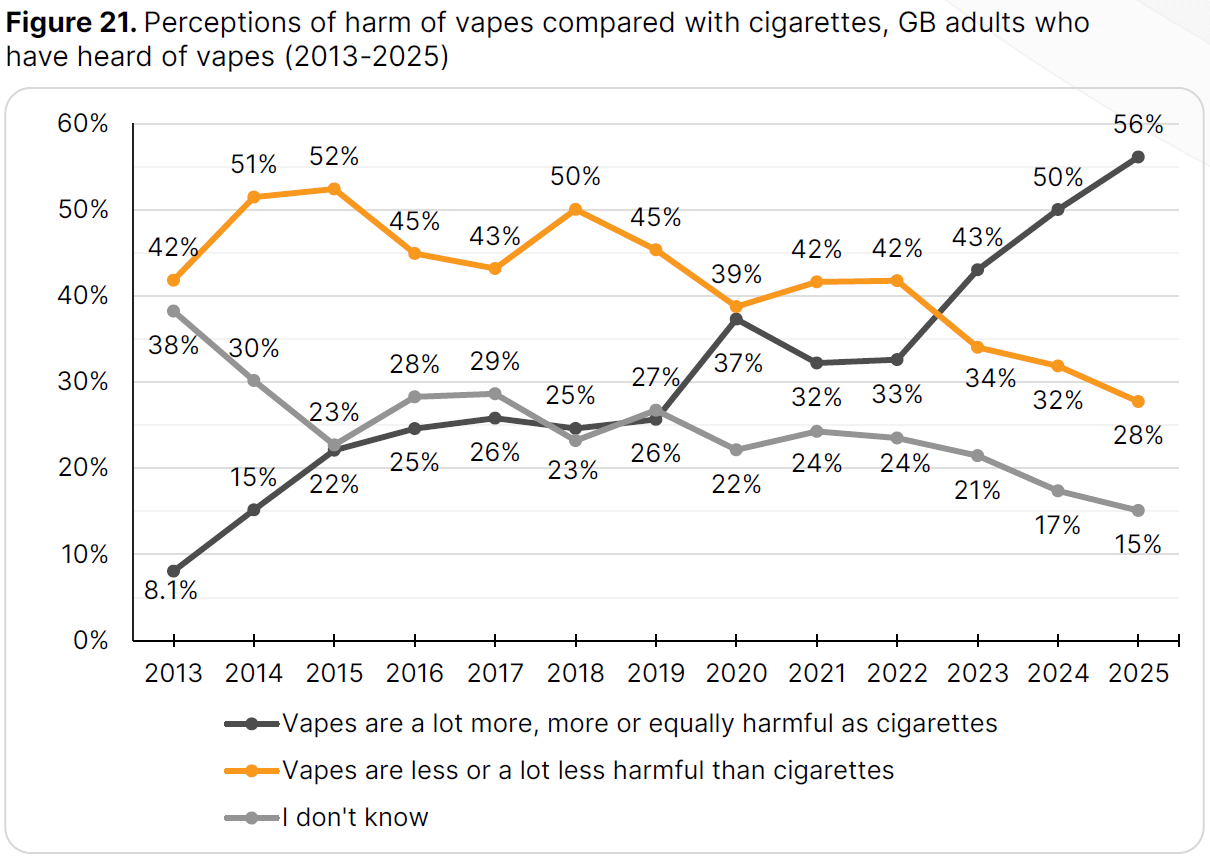

Public misconceptions about the dangers of using e-cigarettes

• 56% of the public believes vaping is as/more harmful than smoking.

• Misperceptions are highest among smokers who have never vaped.

• Misperceptions are higher among smokers in social grades C2DE than ABC1.

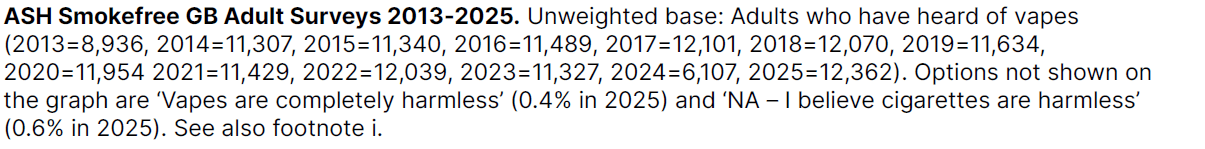

Smokers of different social classes have their own perception of the dangers of e-cigarettes

• Misconceptions About E-Cigarettes Among Working-Class Smokers (57%) Are Significantly Higher Than Among Middle/Upper-Class Groups (48%).

• Only ~1% of smokers hold polarised views (believing e-cigarettes are "completely harmless"), but working-class individuals' accurate understanding rate (24%) is less than two-thirds of middle/upper-class groups (36%).

• 60% of healthcare professionals (sample size: 854) incorrectly believe e-cigarettes are equally or more harmful than smoking.

Changes in Consumer Preferences Post Disposable Ban

Analysis of Device Preferences, Flavor Choices, Nicotine Strengths & Consumption Behavior

The impact of the ban has led to a decline in once-popular disposable e-cigarettes. Fruit flavors now dominate the market with a 51% share, becoming the clear mainstream choice, while ice-cool products attract younger demographics, driving surging demand for sensory experiences.

Device Migration Under the Ban

Disposable e-cigarettes are restricted by policies, peaking at 31% in 2023 before declining to 24% in 2025; pod system market share doubled from 15% in 2024 to 25% in 2025, as disposable brands (e.g. Elf Bar) expanded into the pod market; despite tank systems' share dropping from 77% in 2021 to 50%, they still hold half the market, reflecting veteran users' loyalty to customizable devices.

• Main device: 50% tank systems, 25% pod devices, 24% disposables,

• Disposable use peaked in 2023 and appears to be declining.

• Most popular : Disposables: Elf Bar (38%), Crystal Bar (35%), Lost Mary(33%); Pod devices: Blu (15%), Elf Bar (15%), Voopoo (14%), Lost Mary (14%); Tank systems: Aspire (19%), Vaporesso (18%), Smok (14%).

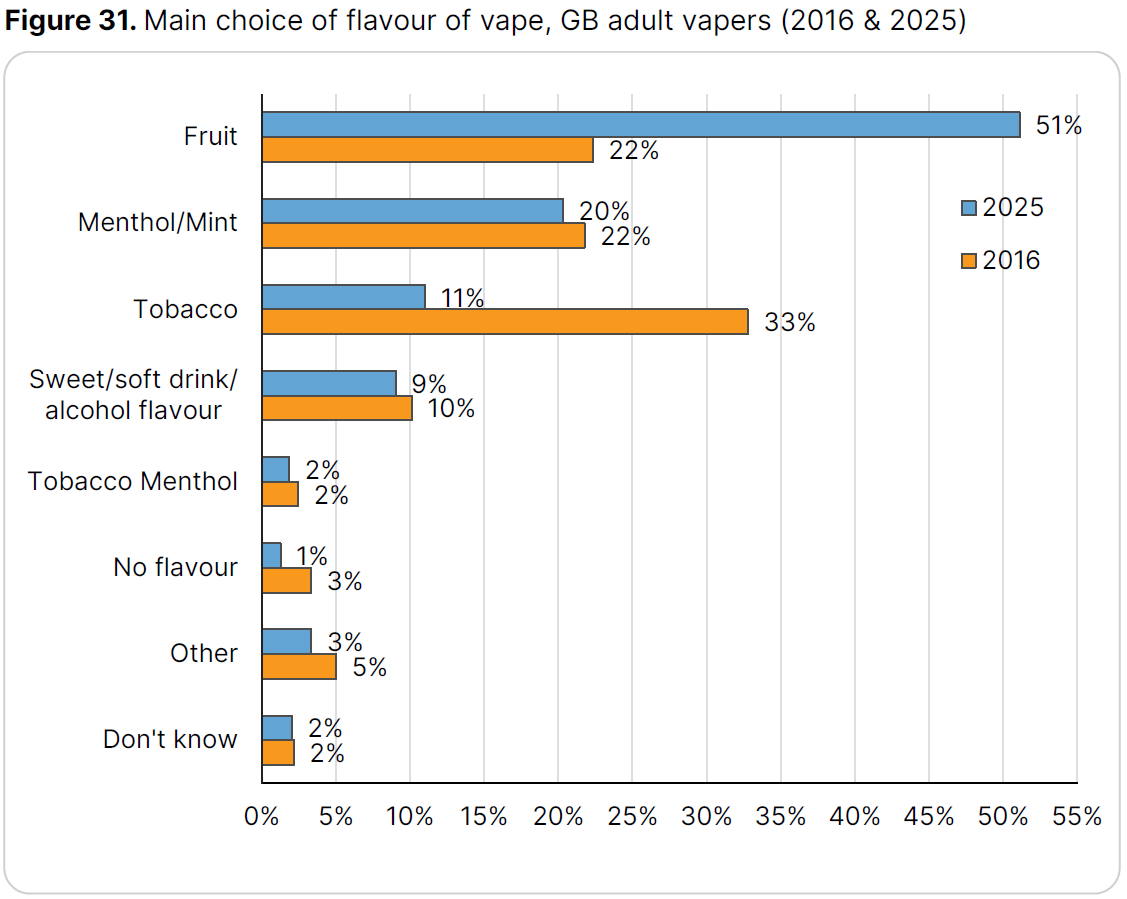

Analysis of Flavor and Ice Sensation Trends

Popular flavor distribution: Fruit (51%), Menthol/Mint (20%), Tobacco (11%),41% of vapers sometimes or always use ‘ice’ flavors.

• Fruit flavors continue to rise (2016~2025: increased from 22% to 51%), while tobacco flavors steadily decline (2016~2025: decreased from 33% to 11%).

• Former smokers (now using e-cigarettes): 74% stick to the same flavor.

• Dual users: only 61% maintain consistent flavor preferences.

Analysis of Nicotine Concentration and Consumer Behavior

Regulations under the EU Tobacco Products Directive (TPD): Maximum nicotine concentration limit: 20mg/ml (2%)

• 84% use strength within legal limits (≤20mg/ml).

• 30% of vapers have reduced nicotine strength over time.

• 10% currently use "shake and vape"(shortfll + nicotine shot)products.

Purchase Channels and Promotion Awareness

Research on user product sources and promotion awareness

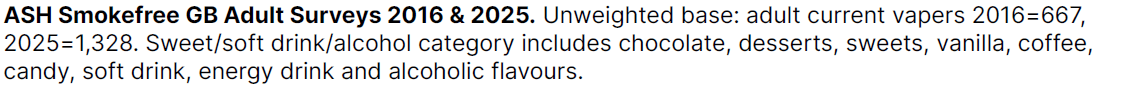

Smokers rely on traditional retail channels (supermarkets + convenience stores account for 92%). E-cigarette users prefer specialized channels (specialty stores + online shopping account for 68%). Dual users (using both cigarettes and e-cigarettes) show the same pattern. Proves channel selection is driven by product characteristics (e.g., e-cigarettes require professional knowledge/varied choices).

Product Sources for Adult E-cigarette Users

Smokers heavily rely on traditional offline channels, especially supermarkets/convenience stores, while e-cigarette users show a significant preference for online shopping; smokers have higher acquisition rates through "second-hand transfers".

• 29% of vapers use vape shops; 39% purchase online.

• Smokers favour supermarkets and corner shops.

Analysis of Promotion Awareness Among Adult E-cigarette Users

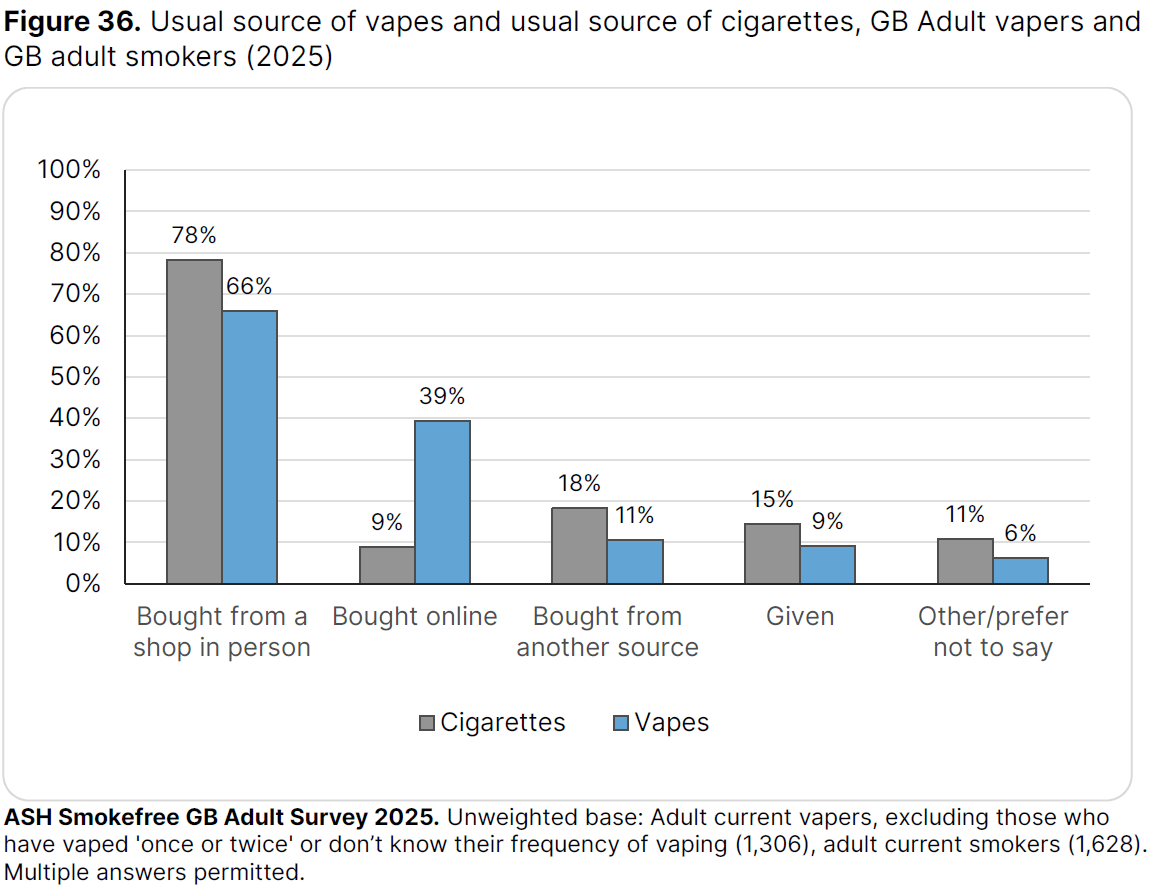

Over half of users have noticed e-cigarette promotions, with younger demographics being more sensitive to online promotions (e.g., social media ads), while physical store promotions cover all age groups (50%), though elderly users still show low awareness due to limited offline participation.

• 60% of adults reported noticing e-cigarette promotions.

• Significant age differences: 18-24 years: only 20% unaware of any promotions (highest awareness), 65+ years: 36% unaware of promotions (lowest awareness).

• Promotion channel distribution comparison: Physical store awareness rate: 50%, Online channel awareness rate: 20%.

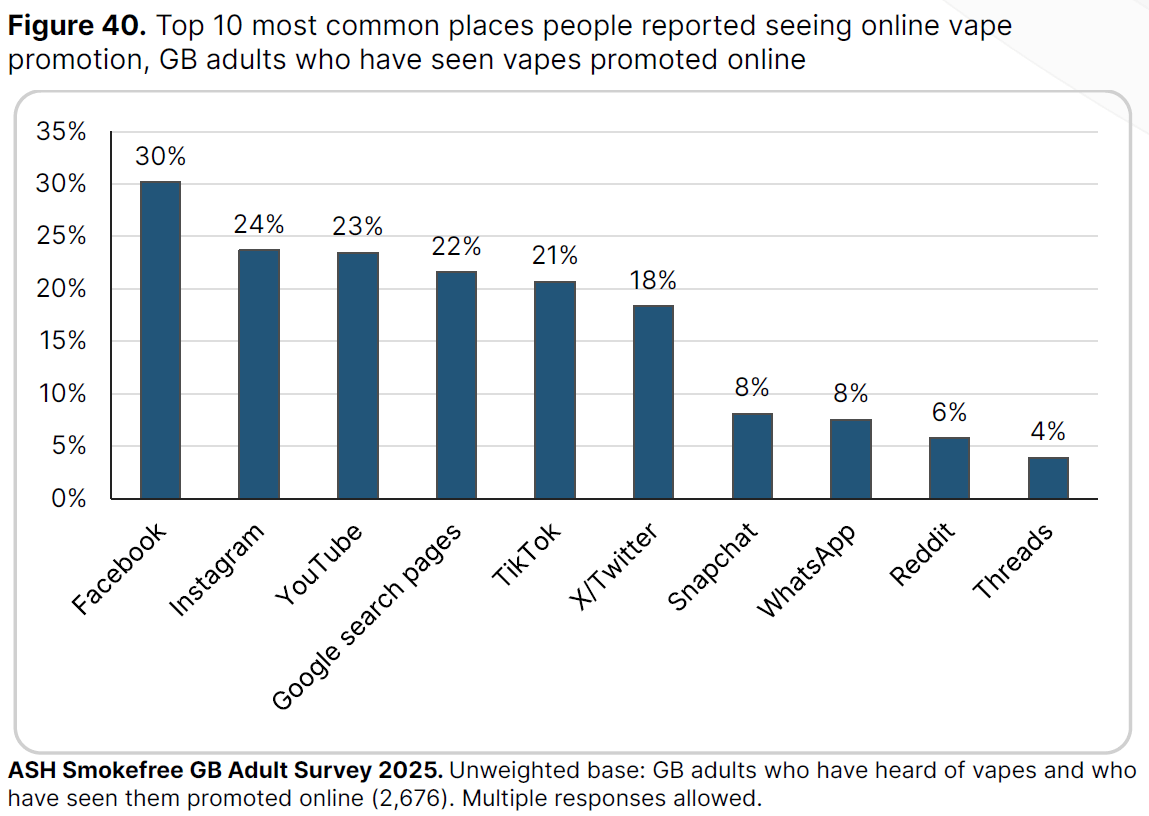

Analysis of Top 10 Platforms for UK Adults' Exposure to E-cigarette Online Promotions Reveals: Facebook+Instagram Serve as Primary Marketing Channels, While Short-Video Platforms (Instagram/TikTok) Also Hold Significant Influence.

• Meta Platforms Dominate: Facebook+Instagram collectively account for a 54% share, serving as the dominant platforms.

• Youth Demographic Divergence: 18-24 age group shows significantly higher promotion exposure rates on Instagram/TikTok (43%/39%) compared to Facebook (24%).

Anticipated Behavior Under Policy Changes

Impact of disposable e-cigarette ban on adult users & potential effects of flavor restrictions

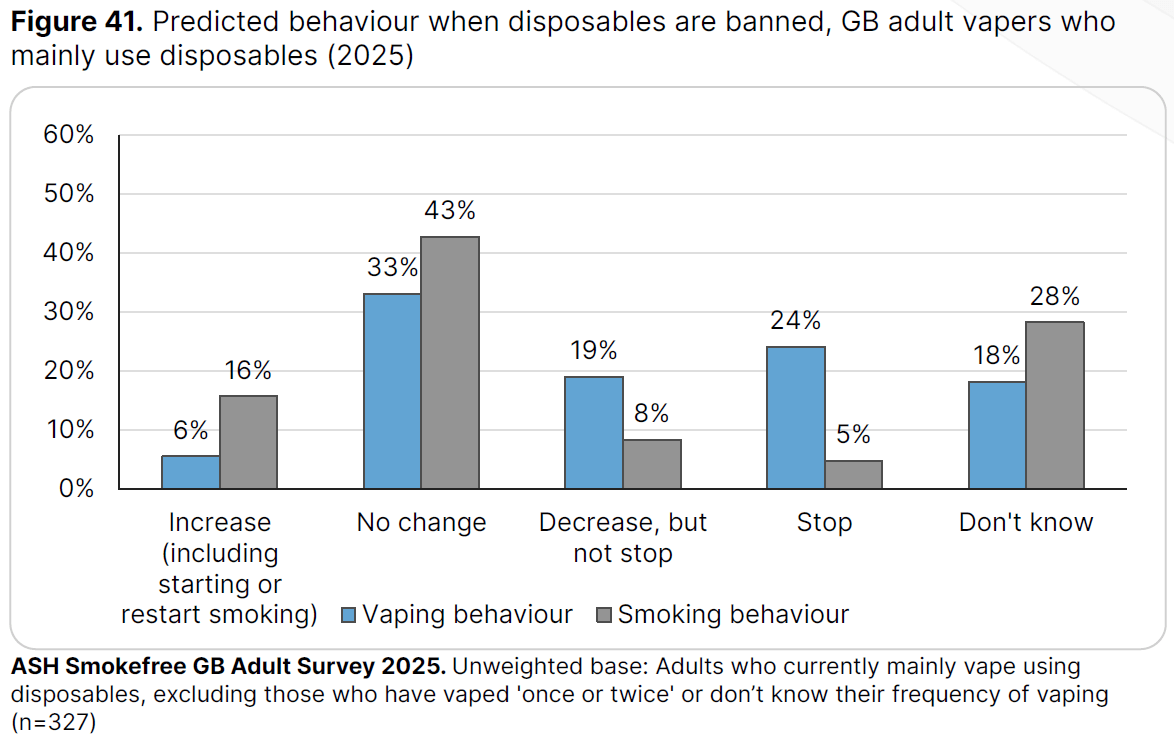

The disposable ban will create a double-edged effect: while reducing disposable product usage, it may lead 16% of users to return to smoking; simultaneously, risks associated with illicit markets require vigilance.

Expected Behavior of Adult E-cigarette Users Under the Ban

Adult e-cigarette users are more likely to decrease rather than increase usage.

• 24% indicate they will completely stop use.

• 19% will reduce usage.

• Only 6% will increase usage.

Chain Reactions on Smoking Behavior:

• 16% indicated they might consequently increase cigarette smoking.

• 13% believed it would reduce cigarette smoking.

Conclusion

The 2025 ASH survey on adult vaping in the UK suggests that policy changes are beginning to shape the market landscape. Vaping prevalence has declined for the first time, while the ban on disposable devices is gradually affecting user behaviour and consumption patterns. These findings can provide a useful reference for vaping brands and industry stakeholders seeking to understand better and adapt to the latest developments in the UK market.

Use of vapes (e‑cigarettes) among adults in Great Britain – ASH

ABOUT HANGSEN

Hangsen is one of the largest global e-liquid manufacturers. Since we established the industry’s manufacturing standards and introduced VG+PG as the base liquid for e-liquids, our business has expanded to over 80 countries and regions worldwide.

The world’s top e-cigarette brands and tobacco enterprises are our loyal clients. With over 60,000 e-liquid flavor formulations developed to date, Hangsen continues to empower global vape brands with premium e-liquid manufacturing solutions.

For inquiries about e-liquid OEM/ODM services, please reach out to us at service@hangsen.com