Table of Contents

- Key Laws Governing E-Cigarettes in Germany

- Product, Labeling, and Packaging Requirements

- TPD Product Registration and Notification

- Vape Taxation and Tax Stamp Requirements

- Marketing and Advertising Restrictions

- Retail Channel Limitations

- Regulatory Authorities for E-Cigarettes

- Compliance Recommendations for Market Entry

Germany is one of the top three e-cigarette markets in Europe, characterized by both a large market size and a fast growth rate. At the same time, it is also known for having some of the most active enforcement practices in the industry, even if the overall regulatory environment is moderate by international standards. The total market value has already surpassed €1.5 billion, with e-liquids alone accounting for over $500 million, and more than 3 million active users nationwide.

This strong consumer demand has drawn increased attention from regulators, leading to a series of policy crackdowns and reforms. Outdoor advertising has been fully banned since 2024, and online marketing is subject to strict limitations. The excise tax on e-liquids is being raised annually and is expected to reach €0.32 per milliliter by 2026, potentially making Germany the highest-taxed e-liquid market in Europe. A national tax stamp system is currently being implemented, and products without proper tax labeling or registration face severe penalties. Additionally, a full ban on disposable e-cigarettes is expected to be enforced nationwide starting in 2025.

During the 2023 Hall of Vape exhibition in Stuttgart, multiple well-known brands had their products confiscated on-site for failing to display tax stamps or submit required product notifications, once again underscoring Germany’s strict approach to enforcement in the vaping sector.

For businesses aiming to enter the German market, understanding the local regulatory framework in detail is not just recommended—it is the critical first step toward long-term compliance and success.

Die Regulierung von E-Zigaretten in Deutschland gilt als insgesamt moderat und orientiert sich weitgehend an der EU-TPD, mit einigen länderspezifischen Abweichungen. Seit 2024 ist Werbung verboten, die Verbrauchsteuer steigt schrittweise auf voraussichtlich 0,32 € pro Milliliter bis 2026. Ein Verbot von Einweg-E-Zigaretten ab 2025 ist sehr wahrscheinlich.

Yes, vaping is legal in Germany. Under the EU Tobacco Products Directive (TPD) and relevant German regulations, all vaping products must meet compliance requirements before they can be sold. This includes devices, nicotine salt, and freebase e-liquids, as well as DIY products such as base liquids, longfills, and flavor concentrates. These products must go through the appropriate procedures, including product notification, labeling compliance, and ingredient restrictions, to be legally marketed in Germany.

E-Zigaretten sind in Deutschland legal – einschließlich Liquids, Einwegprodukte, offenen Systemen und geschlossenen Pod-Geräten. Voraussetzung ist die Einhaltung der EU-TPD sowie der nationalen Vorschriften.

As of now, the sale and use of disposable e-cigarettes are still legal in Germany. However, in late 2024, the Federal Council approved a proposal supporting a nationwide ban on disposables, citing environmental concerns, battery waste, and youth usage. This proposal is now under legislative review by the Bundestag and could take effect in mid-2025 or 2026.

If passed, Germany would join countries like France and Ireland in banning disposable vapes. In light of this trend, brands and distributors should proactively manage inventory, adjust product portfolios, and focus on refillable and open-system devices to reduce regulatory risk.

With a nationwide ban on disposables likely to take effect, BAR SALTS e-liquids may also gain traction, thanks to their combination of flavor intensity and nicotine strength, they serve as a potential replacement for disposable vapes.

Angesichts eines möglichen Verbots von Einweg-E-Zigaretten wird Marken und Händlern empfohlen, ihre Lagerbestände proaktiv zu steuern und sich verstärkt auf nachfüllbare und offene Systeme zu konzentrieren, um regulatorische Risiken zu minimieren.

Germany’s e-cigarette industry is regulated by both EU-level directives and national legislation. Businesses must comply with the European Tobacco Products Directive (TPD) as well as German laws concerning taxation, packaging, battery and electrical safety, environmental responsibility, product safety, and advertising.

The regulatory framework covers the entire product lifecycle—from ingredients and labeling to recycling and market surveillance. Companies are required to ensure compliance across all stages, including formulation, registration, marketing, and distribution.

The Tabakerzeugnisgesetz (Tobacco Act) is Germany’s primary legal instrument for implementing the EU TPD. It outlines obligations for product registration, ingredient limitations, packaging standards, and market authorization.

Supporting this, the Tabakerzeugnisverordnung (Tobacco Ordinance) provides detailed specifications for product labeling, submission formats, banned substances, and graphic warning requirements.

The Tabaksteuergesetz (Tobacco Tax Act) governs excise taxation on e-liquids, defines the tax scope, and details the process for obtaining and applying tax stamps (Stempelmarken). It also sets out penalties for non-compliance.

The Jugendschutzgesetz (Youth Protection Act) prohibits the sale of e-cigarette products to individuals under 18 years of age, both online and in physical retail environments.

The Nichtraucherschutzgesetz (Non-Smokers Protection Act) restricts the use of e-cigarettes in public places such as public transport, government offices, and other designated non-smoking areas.

The Battery Act (Batteriegesetz) requires that all battery-powered products be registered and labeled appropriately. Manufacturers and importers must also fulfill battery recycling and take-back obligations.

The Packaging Act (Verpackungsgesetz) obliges all producers to register their packaging with the LUCID system and participate in a certified recycling scheme in accordance with extended producer responsibility rules.

1. Device Requirements

An e-cigarette device is defined as any system that heats and vaporizes liquid for inhalation.

This includes:

• Disposable e-cigarettes (with prefilled e-liquid);

• Rechargeable devices with replaceable pods or refillable tanks.

Requirements

Disposable vapes or pre-filled pods (Einwegzigaretten / Einwegkartuschen)

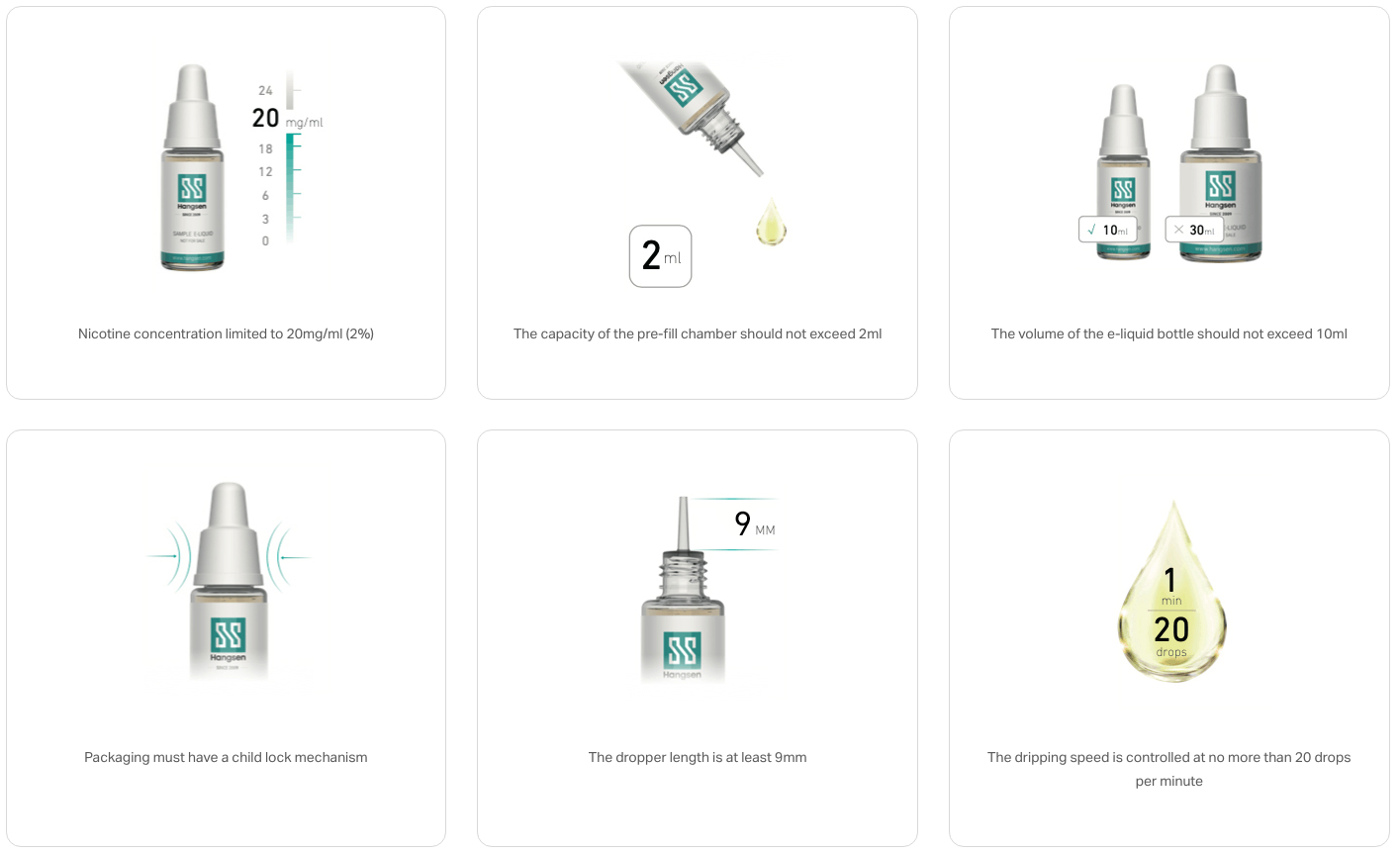

Closed-system and disposable products must not exceed 2 ml in e-liquid capacity.

Open-system devices (nachfüllbare Pods oder RDAs)

The law does not impose a specific volume restriction on open systems. In practice, large-capacity refillable pods and RDA/RTA atomizers are widely available on major German retail platforms.

Child-resistant & leakproof construction

All refillable e-cigarette products must be equipped with child-resistant mechanisms and leakproof refilling systems to comply with §14(3) safety requirements.

E-liquids refer to the liquid used in e-cigarette devices, whether nicotine-containing or not.

This includes:

• Nicotine salt e-liquids (e.g., 10 ml)

• Shortfill / Longfill products

• Flavor concentrates

Requirements (Nicotine-containing Liquids)

• Maximum volume: 10 ml per container

• Bottle must have a tamper-evident and leakproof design

Nozzle specifications

• Length ≥ 9 mm

• Diameter smaller than tank opening

• Drip rate ≤ 20 drops/min under normal pressure

Liquid should only be released when connected to the device.

Whether it is e-cigarette devices or e-liquid, Maximum nicotine concentration: 20 mg/ml (2%)

Prohibited Specified Ingredients/Additives

• Vitamins or other additives that create the impression that a product has a health benefit or presents reduced health risks;

• Caffeine or taurine, or other additives that are associated with energy and vitality;

• Additives that have coloring properties for emissions.

• Additives that have carcinogenic, mutagenic, or reprotoxic (CMR) properties in unburned form;

• Ingredients other than nicotine that pose a risk to human health in heated or unheated form, including flavourings and substances derived from plants.

Prohibited Flavoring Ingredients

The following flavoring substances are prohibited in e-cigarettes and refill containers under German law, due to their potential health risks in heated or unheated form:

• Diacetyl (2,3-butanedione) – CAS No. 431-03-8

• 2,3-Pentanedione – CAS No. 600-14-6

• 2,3-Hexanedione – CAS No. 3848-24-6

• 2,3-Heptanedione – CAS No. 96-04-8

• Coumarin

Health warnings (for nicotine-containing products):

Must appear in German on ≥30% of the front and back of the outer packaging

Example:

Dieses Produkt enthält Nikotin: einen Stoff, der sehr stark abhängig macht.

(This product contains nicotine: a substance that is highly addictive)

Must use black text on white background, sans-serif font (e.g., Helvetica), ≥9 pt, no italics or decorative styles

Labeling content requirements

• Warning must be aligned with package edges, not overlap with logos or designs

• Ingredient list in descending order by weight

• Manufacturer/importer name, address, and website

• Batch number and shelf life (minimum 12 months)

• Nicotine concentration (e.g., "20 mg/ml 2% nicotine")

• Nicotine delivery per puff (e.g., 0.02 mg/puff)

• Statement that the product must not fall into the hands of children and young people.

• A German-language leaflet with instructions, warnings, and contact info must be included

Prohibited designs and claims

• Phrases like “harmless,” “healthy,” “tar-free,” “detox,” “natural,” “medical”

• Images of fruits, desserts, toys, cartoons

• Packaging that resembles food (e.g., candy bags, juice boxes)

• Implied health benefits or smoking cessation claims

Information Leaflet Requirements

Each e-cigarette and refill container sold in Germany must include a leaflet containing the following information:

• Clear instructions for proper use and storage

• Contraindications, including health conditions under which use is not advised

• Warnings stating that the product is not intended for non-smokers, and its use or distribution to children and young people is prohibited

• A list of possible adverse health effects or side effects

• Information on the addictive properties of the product, particularly if it contains nicotine

• Toxicological data, particularly regarding inhalation

• Full contact details of the manufacturer, importer, or a responsible legal or natural person within the EU

Tax stamp placement

• Packaging must reserve space for the German tax stamp (Stempelmarke)

• Should be placed on the seal or top without obscuring warnings or product info

Environmental labeling (VerpackG requirements)

• All packaging must be registered in the LUCID system

• Label must include recyclable symbol (e.g., Der Grüne Punkt)

• Use of separable, recyclable materials is recommended

How to Complete TPD Registration and Notification in Germany?

In Germany, all nicotine-containing e-cigarette products—including disposables, closed-system devices, and e-liquids—must complete TPD registration prior to market entry. This involves submitting product notifications through the EU Common Entry Gate (EU-CEG) system. The registration process includes documentation, product data submission, and in some cases, analytical testing. Fees and procedures vary depending on product type (e-liquid, hardware, etc.) and registration scope (e.g., new submission or major modification).

Registration Process Overview

1. Preparation Phase

Ensure that the product does not contain any TPD-prohibited substances. Packaging must feature a child-resistant and leakproof design. All labeling must be complete, including German health warnings, ingredient list, and manufacturer details. A toxicological summary and emission report must also be prepared.

2. Submission via EU-CEG

The brand owner must create an account on the EU-CEG platform, complete ECAS/EU Login verification, and submit a detailed product notification. Required data includes the full ingredient list, nicotine dosage, aerosol emission results, and toxicological summary.

3. Appoint a Local Representative (Overseas agency)

Companies based outside Germany must appoint a German-based representative to handle the registration and communications with authorities. This includes receiving official notifications, submitting follow-up documentation, and ensuring compliance. A formal authorization agreement is recommended.

4. Pay Registration Fees

Germany charges a one-time registration fee per SKU, currently around €165, which must be paid by the brand owner or their authorized representative. A confirmation is issued upon receipt.

5. Submission Timeline

All documents must be submitted through the EU-CEG system at least six months before the intended market launch. Late submissions will render the product non-compliant and ineligible for sale.

Each SKU requires a separate TPD registration. The obligation lies with the first entity introducing the product to the German market—either a local manufacturer, importer, or authorized representative.

Substantial Modification

A new notification is required if a product is substantially modified, which includes changes in composition or components.

Market Data Notification

Companies must submit an annual report by June 30th each year, providing comprehensive data on sales volumes, consumer preferences, and market surveys.

How Long Does Registration Take?

The standard registration process takes approximately 4–6 weeks, depending on the completeness of documentation and product type. If additional testing or documentation is required, the timeline may extend to over 3 months. Therefore, it is strongly recommended that companies plan well in advance to avoid delays in market launch.

How Much Tax Is Applied to E-Liquids in Germany?

In Germany, excise duty applies even to nicotine-free e-liquids. As of 2025, the duty stands at €0.26/ml. By 2026, the country is expected to have the highest vape tax rate in the EU.

E-Liquid Excise Tax Schedule

• 2024: €0.20/ml

• 2025: €0.26/ml

• 2026: €0.32/ml

Vape Market B2B Insight

The 2025 tax increase is already putting pressure on the German vaping sector. Brands are dealing with higher production costs, narrower margins, and a reduction in product diversity. Many smaller manufacturers have exited the market, while others are forced to streamline their SKUs and reformulate to remain competitive. As the rate climbs further in 2026, additional price hikes and market consolidation are expected.

Due to high taxation levels, a large portion of the German market now prefers Low-tax formats. When building a e-liquid line for Germany, high-concentration and low-volume products, such as Longfill are regarded as the best choices.

For full details, please refer to How Much Tax is Applied to E-Liquids in Germany

How to Apply for a Vape Tax Stamp (Steuerbanderole) in Germany

Since 2022, Germany has imposed an excise tax on both nicotine-containing and nicotine-free e-liquids, along with a tax stamp system similar to that used for traditional tobacco products. This system places additional obligations on manufacturers and importers.

Application process overview:

1. Obtain a German tax number (Steuernummer)

The applicant must either be a German-based company or appoint a local importer with a valid tax ID.

2. Access the tax stamp portal

Submit the application via the German Customs Authority (Zoll) online platform.

3. Declare estimated sales volume

Forecasted volumes must be submitted for each product type and size. This forms the basis for tax stamp allocation and pre-tax calculation.

4. Prepay excise tax and order stamps

Taxes must be paid in advance. Physical tax stamps with unique serial numbers are issued by authorized printing facilities.

5. Affix tax stamps properly

Stamps must be applied to the outer retail packaging—preferably at the seal or a clearly visible location—and must not obscure health warnings.

6. Submit tax stamp data for recordkeeping:

All stamp serial numbers and product declarations must be reported before product launch for audit purposes.

Note

Direct-to-consumer (B2C) shipments from outside Germany may be classified as tax evasion if tax stamps are missing. Unstamped products are considered non-tax-paid and may be confiscated, destroyed, or fined on-site.

Under German tobacco legislation, the retail sale of e-cigarettes—whether containing nicotine or not—is permitted only if the seller has implemented a legally compliant age verification system that ensures all purchasers are at least 18 years old, as required by the Youth Protection Act (Jugendschutzgesetz).

The sale of e-cigarettes via vending machines is prohibited, unless the machines are installed in locations inaccessible to minors, such as age-restricted premises. This restriction applies to both nicotine-containing and nicotine-free products.

Retailers engaged in cross-border distance sales of e-cigarette products to consumers in Germany (e.g., through online stores) are required to submit an electronic notification to the Federal Office of Consumer Protection and Food Safety (BVL) before beginning distribution.

The notification must include the following information:

• Company or retailer name (including trade name, if different)

• Primary business address

• Start date (or expected start date) of cross-border product supply

• Website(s) through which the products are offered

• Description of the age verification system in use

Any other information required by the Federal Ministry of Food and Agriculture (BMEL) or the Federal Ministry of Finance (BMF)

Once the notification is reviewed and confirmed by BVL, the retailer may begin legally supplying products to German consumers. This requirement applies specifically to foreign or domestic businesses conducting distance sales into Germany.

For detailed instructions and access to the notification form, visit the BVL official site:

https://www.bvl.bund.de

In Germany, marketing of nicotine-containing e-cigarettes is heavily restricted. Only specific promotional activities are allowed under strict conditions.

Permitted marketing channels include:

Age-verified websites

Brand websites and e-commerce platforms may present product information, but must implement age verification mechanisms.

Direct mail and newsletters

Email campaigns are allowed only if recipients have been verified as adults.

B2B promotional activities

Product promotion is permitted during trade fairs, industry exhibitions, and direct sales visits targeting retailers and distributors.

In-store display

Products may be displayed inside retail stores but must not be visible through shop windows or placed outdoors in ways that attract minors.

Prohibited marketing activities include:

Outdoor advertising

Banned across all formats, including billboards, bus stops, subways, and building exteriors.

Public social media promotion

Promotion on platforms like TikTok, Instagram, or similar public channels is not allowed.

Free giveaways, discounts, and sweepstakes

All forms of promotional incentives are prohibited.

Advertising on television, radio, and in cinemas

All mass media advertisements are banned.

Misleading claims or youth-targeted design

Use of terms such as "healthy," "harmless," "tar-free," or "cleansing" is forbidden, as are cartoon characters, candy-style packaging, or food-like visuals that may appeal to minors.

Several government agencies and compliance platforms are involved in the regulation of e-cigarettes in Germany.

BVL (Federal Office of Consumer Protection and Food Safety)

BLV - Manages TPD product registration data and oversees Germany’s interface with the EU-CEG system.

BfR (Federal Institute for Risk Assessment)

BfR - Evaluates toxicological risks of ingredients and provides scientific recommendations to regulatory authorities.

German Customs and Ministry of Finance (Zoll)

Zoll - Oversees excise tax enforcement, tax stamp management, and inspection of untaxed or undeclared products.

State-Level Market Authorities (Länder Behörden)

Länder Behörden are the state-level authorities in Germany tasked with enforcing e-cigarette laws locally. They handle inspections, advertising enforcement, and respond to violations in retail and online channels.

GRS (Gemeinsames Rücknahmesystem):

GRS - Manages battery return and compliance under Germany’s Battery Act (BattG) for e-cigarettes with built-in or replaceable batteries.

Recommended step-by-step compliance plan

Determine whether your product contains nicotine, and initiate TPD registration under the Tabakerzeugnisgesetz (TabakerzG).

Prepare product labels and packaging in accordance with TabakerzV and the Verpackungsgesetz (Packaging Act).

Register for a WEEE number and fulfill battery compliance under ElektroG and BattG, especially for devices or disposables with built-in batteries.

Obtain a German tax ID and apply for tax stamps (Stempelmarken).

Appoint a German-based compliance representative to handle communication with authorities and support the registration process.

Establish internal review procedures to verify packaging compliance and maintain documentation before sales launch.

How Hangsen Can Help You Start Your Business

End-to-End E-Liquid Solutions

Hangsen provides comprehensive support throughout the entire process, from flavor development and testing to packaging design and distribution.

Flavor Customization

With years of experience, Hangsen excels at creating custom flavors that cater to the preferences of European consumers, including those in Germany.

Regulatory Compliance

Hangsen offers expert guidance on adhering to German and EU regulations, ensuring that your products meet all legal requirements.

Logistics Support

Hangsen works with trusted logistics partners in Europe, providing efficient and reliable delivery services to support your supply chain operations.

For more service information, please contact us at service@hangsen.com